Fraudster Sam Bankman-Fried is a Pathetic Character and a Product of our Time

WeWorking the System

By Bill Clifford — CEO, Spencer Trask & Co.

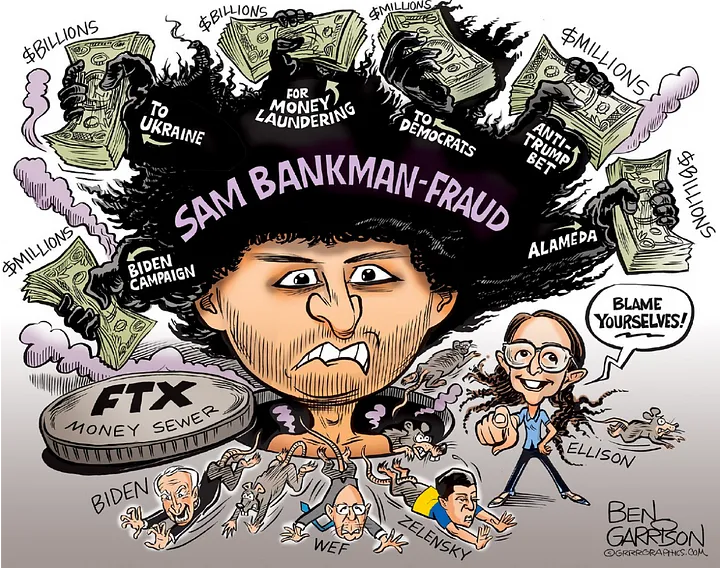

Several weeks have passed since a spoiled millennial from the Silicon Valley has been exposed as one of the most prolific con men of the 21st Century. Sam Bankman-Fried (aka SBF) has allegedly perpetrated one of the costliest frauds in the history of the financial markets and duped his investors and clients out of tens of billions of dollars. The ex-CEO was scheduled to testify today as a “witness” before the U.S. House of Representatives Committee on Financial Services but was arrested late Monday afternoon in the Bahamas at the request of the U.S. government. The Committee has begun its investigation of the events that led up to the implosion of the crypto exchange FTX and its filing for bankruptcy last month.

. . .

To recap: A man in his mid 20’s chased untold wealth when starting a cryptocurrency hedge fund called Alameda Research (Alameda) in 2017. He began making money hand over fist — so much so that he became a highly influential figure in the crypto world. He then founded a crypto trading exchange called FTX in 2019, backed by the biggest names in Venture Capital. His close association with Alameda and the discovery of transfers of large sums of money to Alameda, which were allegedly lost in high risk trades, caused FTX to be caught short when investors sought redemption earlier this year. Now he’s peddling canned mea culpas via press interviews while confessing to making some rookie mistakes and pleading ignorance and seeking forgiveness. Welcome to the SBF apology tour.

. . .

Ultimately, a failed acquisition to purchase FTX’s non-U.S. businesses by early investor and eventual competitor Binance would prove SBF’s final undoing. Binance backed out of the “Hail Mary’’ deal on Nov. 9, 2022 after a brief period of corporate due diligence and examination of FTX financials. This led to FTX’s bankruptcy declaration on Nov. 11, 2022, the resignation of SBF as CEO, and the appointment of a caretaker CEO designed to recover as much cash as possible for investors and clients. While SBF initially fled the U.S. for the Bahamas in Sep. 2021, reportedly citing a more favorable regulatory environment, one could posit his move was also a tactic to avoid forthcoming prosecution. His net worth would plummet from $72B to $100,000 as FTX valuation fell to zero. Gone are the goals of Benevolent Altruism he so proudly espoused when making money so easy in the early days of FTX.

There is no denying that SBF is intelligent. Many have commented on his ability to conduct a potential investor call while at the same time playing the League of Legends video game. I’m sure his MIT degree in Physics prepared him appropriately for the many vectors associated with market ups, downs and tangents. However, in my view, the scruffy hair, wrinkled tee shirts and ever-present cargo shorts was a facade to project that SBF was simply “too cool for school” to be bothered to care about his personal appearance, which likely distracted from his incompetence in business.

After starting cryptocurrency trading firm Alameda with great success, SBF was making obscene amounts of money in Crypto trading. So much so that he became a notable and significant donor in the 2020 Presidential elections, contributing $5.2M to the campaign of Joe Biden alone. According to SBF, he gave liberally to both parties, so much so that at nearly $40M he was the second largest contributor to Democrat politicians for the 2022 midterm elections — second only to George Soros. He contends that his contributions to Republican causes are not as well publicized because they would not be well received by his Democrat friends or his parents. Also noteworthy is the fact that his mother is the president of a California-based left wing PAC called Mind the Gap that raised $140M for Democrat causes.

That $40M in political donations to Democrats may be the smartest investment SBF ever made since it may be the one that proves the age old theorem — “never bite the hand that feeds you!” How could Maxine Waters come down hard on SBF? There are hundreds of photos in circulation with her arms wrapped around his waist, smiling from ear to ear after SBF tickled her campaign coffers with a nice contribution during the last election cycle. In all fairness, shouldn’t she and Joe Biden and all the other recipients of these ill-gotten campaign contributions return these funds to the new caretakers of the FTX asset holder so that they can be returned to the investors and clients who were defrauded of their investments as a result of SBF’s actions? It seems the ethical thing to do.

. . .

The FTX collapse is what happens when entitled children are allowed too much power with little to no oversight by the supposed adults in the room.

As this unseemly “drama” continues to play out in the weeks and months ahead, I expect a plethora of Federal indictments coming down the pike. Only time will tell whether financial regulators will act justly to ensure that people never again lose their life savings at the hands of these hype men and schemers.